Filing for Chapter 13 Bankruptcy?

Do you owe tax debt? Are you behind on your mortgage? Are you facing a foreclosure? Is the IRS or a state agency garnishing your wages? Are you behind on your child support obligations and need help catching up?

If so, then filing a Chapter 13 Bankruptcy may help you! A Chapter 13 Bankruptcy helps you organize your debts to create a repayment plan over a three or five year period. It will help you pay down debts that would not qualify for a discharge (“forgiveness”) in a Chapter 7 Bankruptcy. It also stops creditors from taking collection action against you, so long as you can remain current with your bankruptcy payment plan.

Sometimes, even if you have debts that qualify for discharge in a Chapter 7 Bankruptcy, you might still have to file a Chapter 13 bankruptcy based on your annual income.

Chapter 13 bankruptcies are complicated and it can be difficult to navigate paperwork and legal requirements to determine which debts can or cannot be discharged in bankruptcy; and to determine which type of bankruptcy is right for you. An attorney will not only help you determine whether you must file a Chapter 13 Bankruptcy but will also help you establish the payment plan and Court approval to start and complete this type of bankruptcy.

Jessica Nomie Law will guide you through this complicated process and ensure that your questions are answered, and all the necessary paperwork is properly filed so that you can be successful in your Chapter 13 Bankruptcy. Contact Jessica Nomie Law for your free consultation if you’re thinking about a Chapter 13 Bankruptcy situation. Set up an appointment to help you determine whether filing for Chapter 13 is the right step for you to take. We service Chapter 13 Bankruptcy clients throughout Clackamas and Multnomah counties, including Clackamas, Happy Valley, Gresham, and Troutdale, Oregon.

Chapter 13 Bankruptcy Process

There are several requirements that will determine your eligibility to file for Chapter 13 Bankruptcy. The main requirement is around whether you have enough income to propose a repayment plan to pay your creditors , or the type of debt that you have. If you need help paying past due child support, mortgage arrears, or tax debt, then you must file Chapter 13 Bankruptcy. Also, you may be required to file a Chapter 13 Bankruptcy based on your household income.

The overall Chapter 13 Bankruptcy process is:

- Meet with a bankruptcy attorney. Contact Jessica Nomie Law for your free consultation to determine your eligibility for filing a Chapter 13 Bankruptcy.

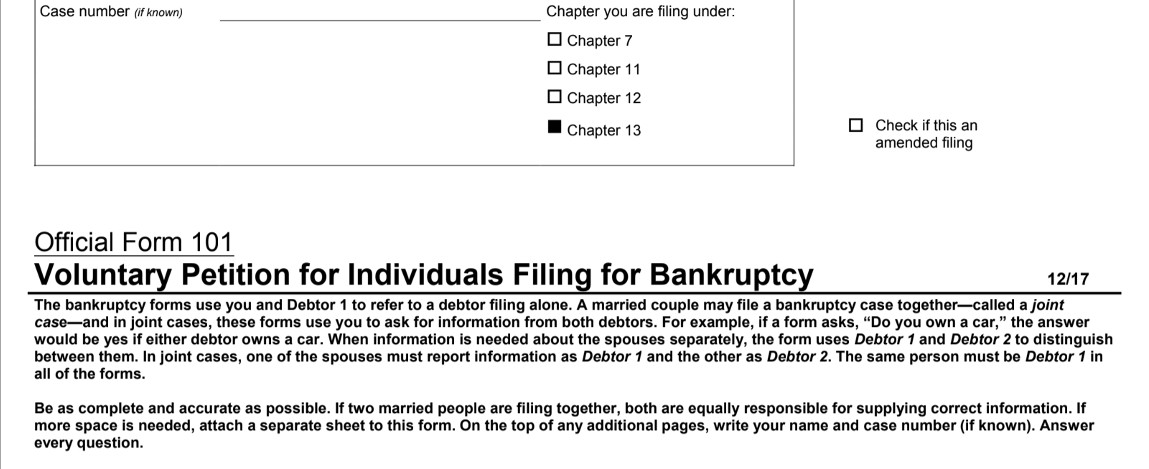

- Compile paperwork and petition preparation. Jessica Nomie Law will assist you with compiling the paperwork and information needed to file your case. Jessica Nomie Law will prepare the bankruptcy petition, schedules and your Chapter 13 payment plan. Once your paperwork is ready we will schedule a meeting with you to review, sign and file your case.

- Credit counseling. You must complete a credit counseling course prior to filing your bankruptcy case.

- File the Chapter 13 Bankruptcy petition. Once filed, the court will appoint a trustee to the case. They will manage the case until the case is discharged by the judge. Part of your petition will be your repayment plan.

- 341 hearing. This is also referred to as the “meeting of creditors.” You will attend a meeting with your appointed trustee and answer any questions asked. Some creditors may also attend this meeting to ask questions as well. If you hire Jessica Nomie Law, then you will have an attorney present with you at this hearing.

- Objections. The trustee will determine if they have any objections to your petition over the next 30 to 60 days. Creditors may also file their own objections during this step in the process.

- Plan modifications. If any objections are raised in the previous step, the plan may be modified to resolve those objections. Your attorney will work with you to address objections and work out modifications.

- Confirmation hearing. This confirmation hearing will be held by the court. Here, the plan will be formally approved by the court once the plan is reviewed. If you hire Jessica Nomie Law, then your attorney will attend this court hearing on your behalf.

- Payments. Payments should be made, per the plan, for the next 3 to 5 years. Occasionally, there may be reports on the payment plan progression. During this time you will also be required to send your tax returns to your attorney each year after they are filed; you may also be required to pay any refunds towards your debts. Your attorney will be able to address any concerns or questions you have during this time.

- Complete debtor’s education course. This is the second part of the educational courses that a debtor must take to file and complete a bankruptcy. You must complete this course to receive your discharge.

- Discharge. You’ll receive a letter in the mail indicating your Chapter 13 Bankruptcy case has been discharged after your last payment is made. Congratulations!

- Rebuild your credit. It’s time to start rebuilding your credit. Jessica Nomie Law will assist you with ensuring your credit report accurately reflects your bankruptcy discharge and will help you contact creditors to fix any errors.

Chapter 13 Bankruptcy Attorney

Contact Jessica Nomie Law for your free consult to determine if filing a Chapter 13 Bankruptcy is the right option for you. Jessica Nomie Law services Chapter 13 Bankruptcy clients throughout Clackamas and Multnomah counties, including Clackamas, Happy Valley, Sandy, Gresham, and Troutdale, Oregon.